Keeping accurate records of business expenses is essential to sound financial management of your business. An easy-to-use small business expense sheet template can make this task much easier for you and your employees.

Why You Need A Small Business Expense Sheet

Maintaining good records provide a number of benefits to business owners. With an accurate record of your expenses, you can better analyze your company’s spending and pinpoint areas of waste, possible theft and opportunities to find cost savings. A reliable accounting of your expenses also better enables you to project budgets and plan for your company’s future. When tax time comes, having a legible, accessible and accurate record of your expenses will better help you and your accountant find potential deductions to reduce your tax liability. Expense records may also be important evidence should you and a vendor or client have a dispute that ends up in court.

Unfortunately, keeping up with expenses is one of the most tedious aspects of running a business. Recording and entering expense data and double-checking it is time consuming and dull. By stream-lining the process as much as possible, you can reduce the amount of time you spend on this monotonous task and better employ your energy and efforts in mission-critical aspects of your business.

Using Our Small Business Expense Sheet Template

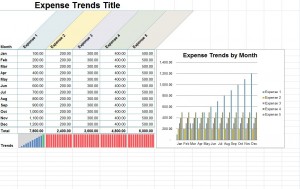

A small business expense sheet template can help you better organize your company’s finances. Our template has customizable, easy-to-change fields you can use to tailor the expense sheet to your company’s specific needs.

Here are some general rules of thumb for setting up a small business expense sheet using our template:

- Make sure to add your company’s name, address, phone number and other contact information to the field. This helps identify the document should it be needed for tax or court purposes.

- Include a field that dates the expense report, allowing both you and your accountant to see what time periods the expense sheet covers and when the sheet was completed.

- Think about what other fields you need. Depending on your business, you may want to have several descriptive fields giving further details about each item on your small business expense sheet. Or you may take a more minimalist approach and have only a few fields on the form. At a bare minimum, you should have fields for a description of the expense, its amount, the date of the purchase and the name of the vendor.

By using a small business expense sheet template, you make keeping accurate expense records easier and more convenient, saving you both hassle and expense.

Download: Small Business Expense Sheet

Check this out while you wait!