22

May

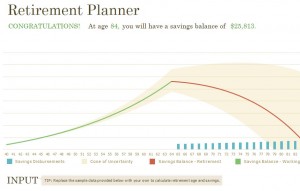

The earlier you start planning for your retirement the better. To be prepared you need an accurate analysis of your savings, construct a plan, and place it in motion. A retirement template will help you realistically set your retirement goals. You’ll see if you are currently saving enough, how long your savings will last, and when you can retire. The Retirement Financial Planner is designed to help you plan.

The customizable Excel template allows you to predict your retirement future. It’s easy to update at any time. The end result is direct and usable information.

How to Use the Retirement Financial Planner

- The Retirement Financial Planner is simple and easy to use. You can either download and save it or open it directly from this page.

- The template is customizable in Excel. You will replace the sample information with your information.

- Next, you’ll input all current pertinent data. Some information to enter includes your current age, income, your retirement savings balance, annual savings amounts, and expected investment returns.

- Secondly, you’ll entire your retirement information. This includes your pension benefits, benefit increases, desired retirement age, and how long you expect to receive the retirement income.

- Finally you can list any uncertainties in the retirement template you may have such as investment returns, annual savings amounts and increases.

- Once all fields have been updated you will have a detailed chart and graph in the retirement template showing you an organized visual of your age, expected salary and savings.

Tips for Using the Retirement Financial Planner

- Feel free to play around with the numbers in the retirement financial planner template.

- Be honest when inputting your information to get the most accurate results.

- If you are not currently receiving income input your most recent salary or possible future earnings.

- If you are unsure of your Social Security benefits the Social Security Administration will have your information available online.

- Be realistic of your income replacement. If you need more than 75 percent of your current income input that.

- If you are unsure of any increase and return rates you can leave the pre-populated fields in the retirement template as is.

- Be sure to update your Retirement Financial Planner when circumstance change such as annual wage difference or a substantial deposit to your savings account.

The Retirement Financial Planner retirement template Excel document found on this page will make your planning effortless.

Download: Retirement Financial Planner

X

Your free template will download in 5 seconds.

Check this out while you wait!

Check this out while you wait!