Handling customer accounts smoothly is a must for any company. Customer accounts often include credit lines, which need special attention and organization. A credit control list is a smart and simple way to keep all credit accounts in the same place and to quickly view the status of each. An organized company will use a customizable free template to organize credit accounts and manage company profits.

Customization provides a fast and professional way for a company to organize its accounts. This free Microsoft Excel template is the perfect way to track individual account current credit extended as well as gain insight on spending habits of each. With this data, a company can ensure that it controls its money wisely.

How to Use the Credit Control List Microsoft Excel Template

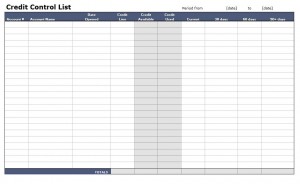

The free Credit Control List Microsoft Excel Template is easy to use and customize. First download the Excel template from this web page. Feel free to add a company logo or header above the title cell. Save the file. Enter in all account numbers and names in the first two columns. Next, fill out the contents of the white cells for each account. These include date opened, credit line, currently available credit, as well as 30, 60 and 90 day options. The blue cells labeled “Credit Available” and “Credit Used” will be calculated automatically and will display the status of each account’s credit line in a polished and professional manner.

Tips for Using the Credit Control List Microsoft Excel Template

- First, easily customize account information for each customer by adding new columns for additional notes or customer identities. Also, rename headers to suit the company’s established terminology and record-keeping procedures.

- Second, use this document to track which accounts are overdue, which have an available credit, and the time frame for each. Easily analyze and act upon the information represented to ensure the company operates smoothly and items are paid on time.

- Be sure to save the file in a safe place and update it on a regular basis. A credit control list is only useful if it is kept current. Current information will ensure a business stays on track and presents a professional face to its customers’ accounts.

Download: Credit Control List

Check this out while you wait!