The cash flow statement is more than liquidity in the bank. Comparison of cash flow statement balance sheets evidences that when financial audit is reconciled, more than one asset class may be critical to accounting control.

Cash flow statement reporting contributes to control of budgetary operations, as well as forecast of investment activities. Conversion of cash flow to operating expense is a fundamental driver to strategic business decision making. By downloading the free Excel cash flow statement template, customizable balance sheet formatting is simple.

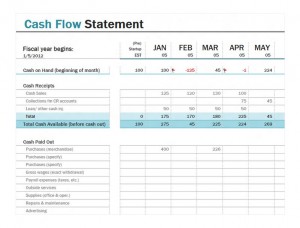

Designed to represent a twelve (12) month fiscal year statement of cash flow, the template includes designated sections for ‘Cash on Hand’, ‘Cash Receipts’ and ‘Cash Paid Out’. Each section is itemized to detail a company’s cash position, reducing the hassle of creating your own cash flow statement.

Here are Some Additional Tips to Better Understanding Cash Flow Statements

- How much cash has increased or decreased is affected by tertiary activities to ‘revenue’ – including sale of investments, sale of plant, property and equipment (PPE) and issuance of stock and/or payment of dividends on company shares.

- Standard balance sheet line items relevant to corporate management oversight are seen in reporting of accounts payable, inventory, marketing, wages and taxes.

- Measure of deviation between forecasted projections and actual financials accounts for financial activities not foreseen in strategic planning, or oft even in day-to-day accountability of expense.

- Liabilities incurred from risk (i.e. insurance litigation) may compound losses sustained from normal depreciation of PPE (property, plant, equipment) and other material assets.

- Timing is critical to meeting strategic management goals in all functions in operational planning. Execution of secondary priorities may be dependent on surplus rather than designated cash contribution.

- Disclosures in reporting support the interests of all stakeholders, including management distribution of funds to activities. Indirect reconciliation requires a separate disclosure. Direct reconciliation of a statement of cash requires three separate disclosures.

- Disclosure of the nature of transactions, timing and up-to-date policy serves to guide sustainable planning.

- Analysis of line-item financial reporting assists managers to make the best decision in forecasting of current ratio, debt ratio and quick ratio in evaluation of departmental decision for the future.

- Streamline the process to accounting control. Cash flow statements are a requisite element of business accounting.

- Use a free Excel template to analyze your company’s next cash flow statement. Seek perfect results for investor publication and audit reporting of accounting statements.

Download: Cash Flow Statement

Check this out while you wait!