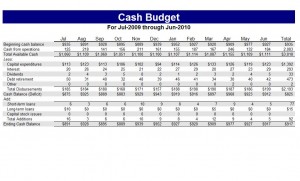

Every business needs to ensure it has an adequate amount of cash available to carry on business activities. A cash budget helps business owners and managers determine if there is any excessive cash or a cash shortage by calculating the budgeted cash inflows, outflows and ending cash balance during each period. A cash budget template for Excel, available for download on this page, is the best, and easiest, way for a business to keep track of this important information.

How to Use the Cash Budget Template Excel Spreadsheet

This cash budget template is customizable, available for free as a download on this page and is easy to use. Here are the simple steps on how to use the template.

Update the subheading section in cell B5 based on what period of time you will be tracking. For example, you might change it to “For Jul-2013 through Jun-2014.”

- Adjust the first month appropriately for your period of time. Using the previous example, you would change cell C7 to “Jul”.

- Fill in the beginning cash balance for the first month and all of the information that is not automatically calculated. The automatically calculated rows are Total Available Cash, Total Disbursements, Cash Balance (Deficit), Total Additions and Ending Cash Balance.

- Fill in the remaining months’ data. Notice that the beginning cash balance for each subsequent month is automatically filled in based on the previous month’s ending cash balance.

Tips for Using the Cash Budget Template Excel Spreadsheet

- First, consider adding your company name and/or logo to the empty cells at the top of the worksheet to make it look more professional.

- Second, each new year’s worksheet can be created by making a copy of the previous year’s worksheet. Simply right click on the worksheet tab at the bottom of the spreadsheet, click “Move or Copy” and check the “Create a Copy” box. Just rename each worksheet based on the year. The other option is to save a new spreadsheet file for each year/period.

- Lastly, and most importantly, pay attention to the details of your cash flow. Are there any expenditures that stand out as much too high? Is your cash situation not as good as it may appear on the surface because regular loans are really what is keeping your cash balance up?

Use this cash budget template to greatly simplify your company’s cash flow management.

Download: Cash Budget Template

Check this out while you wait!