Sometimes in business, you come across customers that do not pay their invoices on time. A business would then use an aged accounts receivable report to keep track of all of these customers. An aged accounts receivable report allows business owners to organize customers that are overdue in their payments. Microsoft Word has conveniently created a special template for conjuring up a professional aged accounts receivable report.

Word is providing companies with a one-of-a-kind template that is free to download and easy to use. Companies are even given the option to customize their templates. This will allow companies to retain their sense of individuality within documents while still being able to write effective reports.

How to Use the Aged Accounts Receivable Report Template

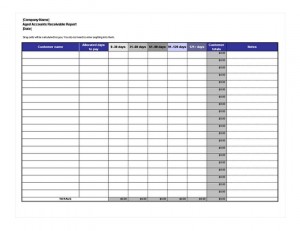

- First, enter your company name on the top left of the template, then save the file. There is also a place on the top left in which you can enter a date that a new document will be created.

- Second, enter the customer’s name along with the date their payments were originally due.

- Third, enter the overdue payments under columns based on how many days the payments are overdue. For example, if a customer has a payment that is 42 days overdue, enter the overdue amount under the “31-60 days” column. Note that the row and column of totals will be calculated for you, so there is no need to enter anything into them.

- Fourth, if there is any details about the customer you need to keep toe of, you can write it down in the notes section.

Tips for Using the Aged Accounts Receivable Report Template

- First, deal with customers in order of urgency based off of how overdue payments are. The longer the payment is overdue, the more urgent the customer. Urgency can also be based off of total amounts overdue.

- Second, pay attention to certain patterns, such as total amounts certain customer owe. Based off of the patterns, you can think of a payment plan to help reduce overdue payments in the future, as well as prevent certain problems from arising.

- Third, use the notes section to keep a close eye on customers. Why are they overdue? When is the soonest time they can pay their next installment? This can help you stay on top of your customers.

- Fourth, keep track of how often to contact customers based on how overdue their payments are. It’s good to keep contact at a minimum in the beginning, then gradually increase over time. Not too much, but just to let your customers know not to forget.

Download: Aged Accounts Receivable Report

Check this out while you wait!