Things depreciate in value; it’s just the facts of life. You can use the Depreciation Calculation Template to calculate the depreciation of your assets with just a few clicks of your mouse and typing some simple information that you already know! This template comes with a simplified or Modified Accelerated Cost Recovery System (MACRS) version you can use to properly assess your assets in a short amount of time. Either way, you choose, you’ll just enter the relevant information, mentioned in the template, and you will instantly receive an accurate calculation of your item and it’s “Book Value.” To learn more about this free template and how to download it, just read the guide below.

Depreciation Calculation Template Guide

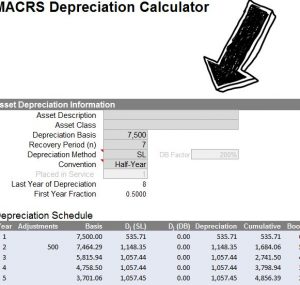

After downloading the template, the first step will be to choose which version of the template you want to use by selecting the tab at the bottom of your screen. There is a basic version and two others that use the MACRS system of depreciation. The other versions will give you a more accurate assessment by taking certain elements into account in addition to the basic version.

At the very top of the Depreciation Calculation sheet, you will find highlighted spaces to enter your asset information. You’ll find things like a description of the asset, asset class, depreciation basis, etc. You will simply go through this first section and enter all the required information.

The next step is to scroll down to the main table to see how your asset will depreciate year after year. Depending on the information, your assets will depreciate a little or a lot through the years.

When you’re ready to move on to the next asset, you can quickly print your document by clicking “File” then “Print” at the top of the page and then write everything over again for your new item.

You can see how easy it is to stay informed about the value of your assets by using this simple and free Depreciation Calculation document.

Download: Depreciation-Calculation Template

Check this out while you wait!