28

May

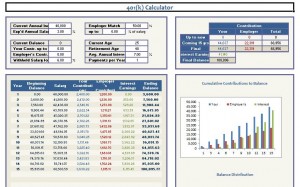

Retirement is one of the things that many people don’t want to think about. It’s complex, difficult and a little frightening. However, retirement is also absolutely critical for the financial stability of an individual and their family. A 401k retirement calculator spreadsheet can help an individual properly plan for their retirement and show them that it is not something that needs to be feared. Proper retirement planning needs to be done as soon as possible so that an individual can build net worth and feel secure.

How to Use the 401k Retirement Calculator

- First, the individual needs to input basic information about themselves into the 401k retirement calculator. This includes their age, the age they will be at retirement, their current investments and their expected annual return. It also includes the types of payments they are making into their 401k and how many payments they are making.

- Once the initial inputs are entered, the 401k retirement calculator will let the user know how much they will make in interest and how much they will have upon retirement. It will also break down the interest gained by year so the individual can see how their interest accrues.

- If the retirement plan looks satisfactory the user can save the 401k retirement calculator template file and stick to their retirement plan. However, if it does not look as though the user is saving enough money they may have to change some of the numbers such as the amount of their contributions and their retirement date until the numbers look more realistic.

Tips for Using the 401k Retirement Calculator

- Individuals need to be realistic about their age of retirement. In the past, retirement was traditionally at the age of 55. After this, it moved to 65. Today, many people will not truly be retiring until they are 70 or perhaps even older. Individuals who aren’t sure about when they will be able to retire should play with the numbers to see what is truly realistic. Very few people today will retire at the age of 55.

- A modest plan that can be followed is far better than an ambitious plan that will fail. Before planning out their retirement an individual should have a firm handle on their monthly expenses and be aware of how much money they can truly save. The amount that an individual puts into their retirement fund cannot cut into their other necessary expenses such as their cost of living because it will not be sustainable.

Download: 401k Retirement Calculator

X

Your free template will download in 5 seconds.

Check this out while you wait!

Check this out while you wait!